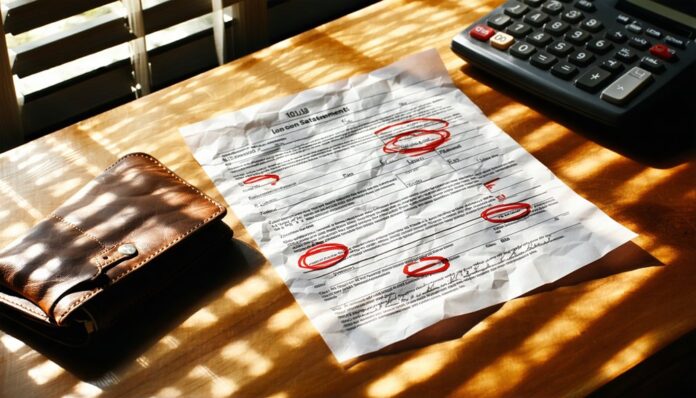

Bill pay loans can quickly become expensive traps for the unprepared borrower. Beyond the basic interest rates, numerous fees lurk beneath the surface of these financial products. From substantial origination charges to hidden administrative costs, the true expense often exceeds initial expectations. Understanding these potential charges becomes crucial for anyone considering this borrowing option, as overlooking even a single fee can transform a manageable loan into a costly burden.

Understanding Interest Charges and APR

Interest charges represent the core cost of borrowing through bill pay loans, with the Annual Percentage Rate (APR) serving as the most comprehensive measure of these expenses.

APR includes not only the base interest rate but also any additional fees rolled into the loan, making it essential for understanding the true cost of borrowing.

Credit scores significantly impact these charges, with rates varying dramatically from 17.18% for borrowers with scores above 720 to over 280% for those below 560.

While the average personal loan rate stands at 12.36%, individual borrowers may face vastly different terms based on their creditworthiness. Nearly half of Americans, specifically 48.7% of borrowers, use these loans for debt consolidation or refinancing credit cards.

Smart borrowers should focus on comparing APRs rather than advertised rates when evaluating loan options, as this metric provides the clearest picture of total borrowing costs.

Common Origination and Setup Costs

Beyond interest charges, origination and setup fees represent significant upfront costs that borrowers must consider when taking out bill pay loans.

These fees typically range from 0.5% to 12% of the loan amount, depending on the type of loan and lender. For example, a 12% origination fee on a $10,000 personal loan would reduce the actual disbursement to $9,200.

Some lenders choose to waive origination fees during slow market periods to attract more borrowers. Borrowers should carefully review fee structures, as they can substantially impact the total cost of borrowing. Some lenders offer the flexibility to pay these fees upfront or roll them into the loan amount.

However, incorporating fees into the loan principal increases the total interest paid over time. To make informed decisions, borrowers should compare APRs across different lenders, as this metric includes origination fees in the overall cost calculation.

Hidden Administrative Fees to Consider

While borrowers often focus on interest rates, hidden administrative fees can significantly impact the total cost of bill pay loans.

These charges may include commitment fees ranging from 0.5% to 2% that lenders require to reserve funds, as well as loan packaging fees for document preparation and underwriting.

Many lenders also impose payment processing fees, particularly for wire transfers or check payments, which typically range from $5 to $25 per transaction. Some financial institutions may charge an insufficient funds fee if automatic payments fail due to inadequate account balances.

When working with brokers or third-party platforms, additional fees may apply, either as flat amounts or percentages of the loan value.

To minimize these costs, borrowers should carefully review all loan documentation, ask for complete fee itemization, and consider selecting lenders who offer free electronic payment options like ACH transfers.

The Real Cost of Late Payments

Late payments can devastate borrowers’ finances far beyond the original loan amount. These fees represent over 10% of the $120 billion consumers pay annually in credit card charges, with the burden falling heaviest on those least able to afford them.

The impact is particularly severe for borrowers with lower credit scores, as nearly half of deep subprime accounts face three or more late fees annually. Credit card late fees reached their highest point at over $14 billion in 2019.

While 85% of superprime borrowers avoid late fees entirely, only 30% of deep subprime borrowers do the same. The penalties can add a 24% surcharge on top of existing interest, creating a crushing cycle of debt.

This disparity affects communities unequally, with low-income and majority-Black neighborhoods experiencing disproportionate impacts from these escalating costs.

Rollover and Loan Extension Charges

Payday loan rollovers represent one of the most costly and prevalent fee traps for borrowers, with over 80% of loans being extended through this mechanism within two weeks. Each rollover incurs a new fee while maintaining the original loan balance, quickly escalating the total cost of borrowing.

For example, a $500 loan might require a $75 fee per rollover, meaning a borrower who extends twice pays $150 in additional charges without reducing their principal.

Similarly, a $1,000 loan rolled over for 30 days can add $250 in new fees to an existing $1,250 balance.

While many states require lenders to offer no-cost extended payment plans, these options often go unused as lenders steer customers toward profitable rollovers, particularly in the less regulated online lending space. Federal law requires that lenders fully disclose the finance charge and APR before any loan agreement is signed.

Early Repayment and Annual Maintenance Fees

Two distinct fees commonly impact bill pay loan costs: early repayment penalties and annual maintenance charges.

Early repayment fees typically follow one of three structures: a flat fee, an interest-based charge, or a percentage of the remaining balance – usually 1-2%. For example, a $200,000 mortgage balance with a 2% prepayment penalty would incur a $4,000 fee if repaid early. Not all personal loans have prepayment penalties, so shopping around is essential.

Annual maintenance fees, while less common in bill pay loans, may range from $50-$100 yearly. These fixed charges continue regardless of loan usage, though some lenders offer first-year waivers.

Borrowers should carefully review their loan agreements for both fee types and calculate whether potential interest savings from early repayment outweigh any penalties. State regulations may limit or prohibit certain fees.

Avoiding Unnecessary Bill Pay Loan Expenses

Minimizing unnecessary expenses in bill pay loans requires vigilant monitoring and strategic planning across multiple cost areas. Consumers can significantly reduce costs by carefully tracking payment due dates to avoid late fees, which often cascade into additional penalties and credit score damage.

Maintaining sufficient account balances prevents costly overdraft charges that average $60 per household annually. Protection against identity fraud, which costs households approximately $76 yearly, involves selecting secure payment platforms and regularly reviewing statements.

Credit-related expenses, averaging $1,186 per household annually, can be minimized through consistent, timely payments. Additionally, understanding convenience and processing fees helps borrowers choose cost-effective payment methods, as these charges can range from 2% to 5% of transaction amounts.

Smart financial management includes comparing payment options to avoid hidden administrative costs. Total hidden costs have seen an 18% increase compared to the previous year’s expenses.

In Conclusion

Bill pay loan borrowers must carefully evaluate all associated fees to make informed borrowing decisions. By understanding origination fees, administrative charges, late payment penalties, and rollover costs, consumers can better assess the true cost of their loans. Thorough review of loan terms and awareness of potential hidden expenses enables borrowers to avoid unnecessary charges and select the most cost-effective financing options for their needs.